In today's fast-paced investment landscape, Venture Capitalists (VCs) are constantly on the lookout...

Investing in Tomorrow's Innovators: Our Journey with the YC S23 Batch

The Forefront of Investment Strategy

At 8vdx Demo Day Fund, our mission has always been to identify and invest in the most promising startups, those that are poised to redefine industries and create new markets. Our recent venture into the YC S23 batch is a testament to this commitment. We don't just participate in YC Demo Day; we're amongst the first to invest, engaging with startups 3-4 weeks before the event. This proactive approach, coupled with our cutting-edge tools, has enabled us to target the top 10% of the batch, meeting our rigorous criteria that encompass founders' expertise, market attractiveness, size, competition, and early traction.

The Power of AI-Driven Investment

Our investment strategy, underpinned by the 8vdx VentureInsights platform, goes beyond traditional methods in early-stage investing. Our AI-powered platform is crucial in navigating the complex landscape of startup investments, especially in diverse and competitive environments like YC S23. With its AI-powered tools, we were able to manage the pipeline of opportunities, analyze startups and we continue to track our investments through our AI-powered Smart Investment Updates.

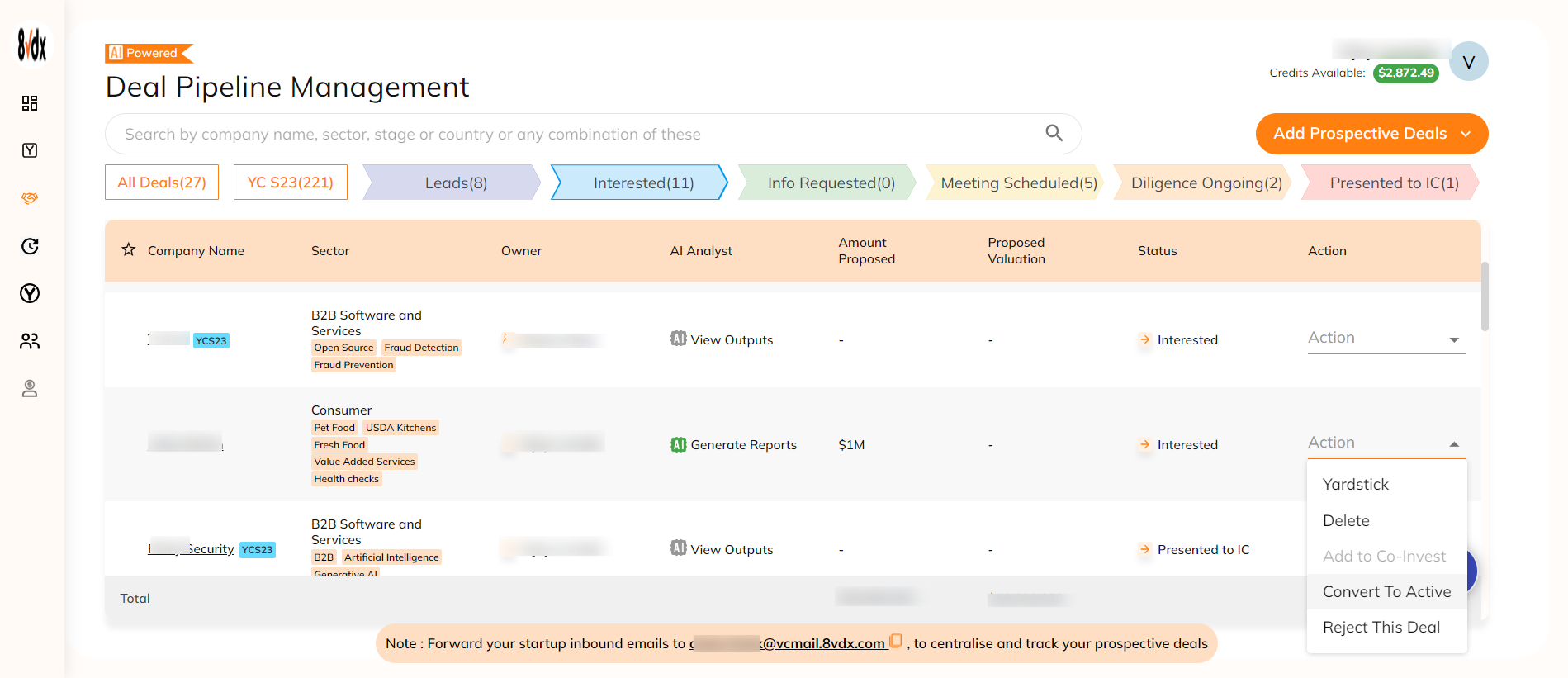

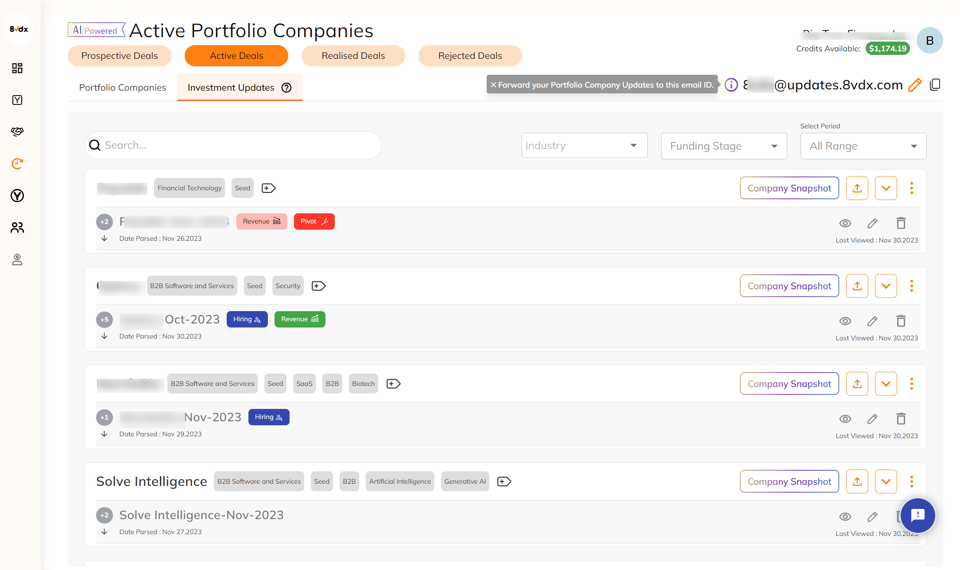

Streamlining the Deal Pipeline

Efficiency is key in managing our investment process, and the AI-driven deal pipeline management system on the 8vdx platform has been transformative. It enables us to effortlessly integrate various communication channels and track deal progress, ensuring that we make our investment decisions within the tight timelines of demo day rounds. This remarkable feature seamlessly integrates inbound communications through various channels, including direct forwarding from the inbox, importing deals from spreadsheets, utilizing quick entry forms for individual deals, and even emailing founders to add deals directly to your pipeline. Additionally, the pipeline management functionality not only encompasses these capabilities but also aids in tracking the progress of deals, from initial leads to active investments.

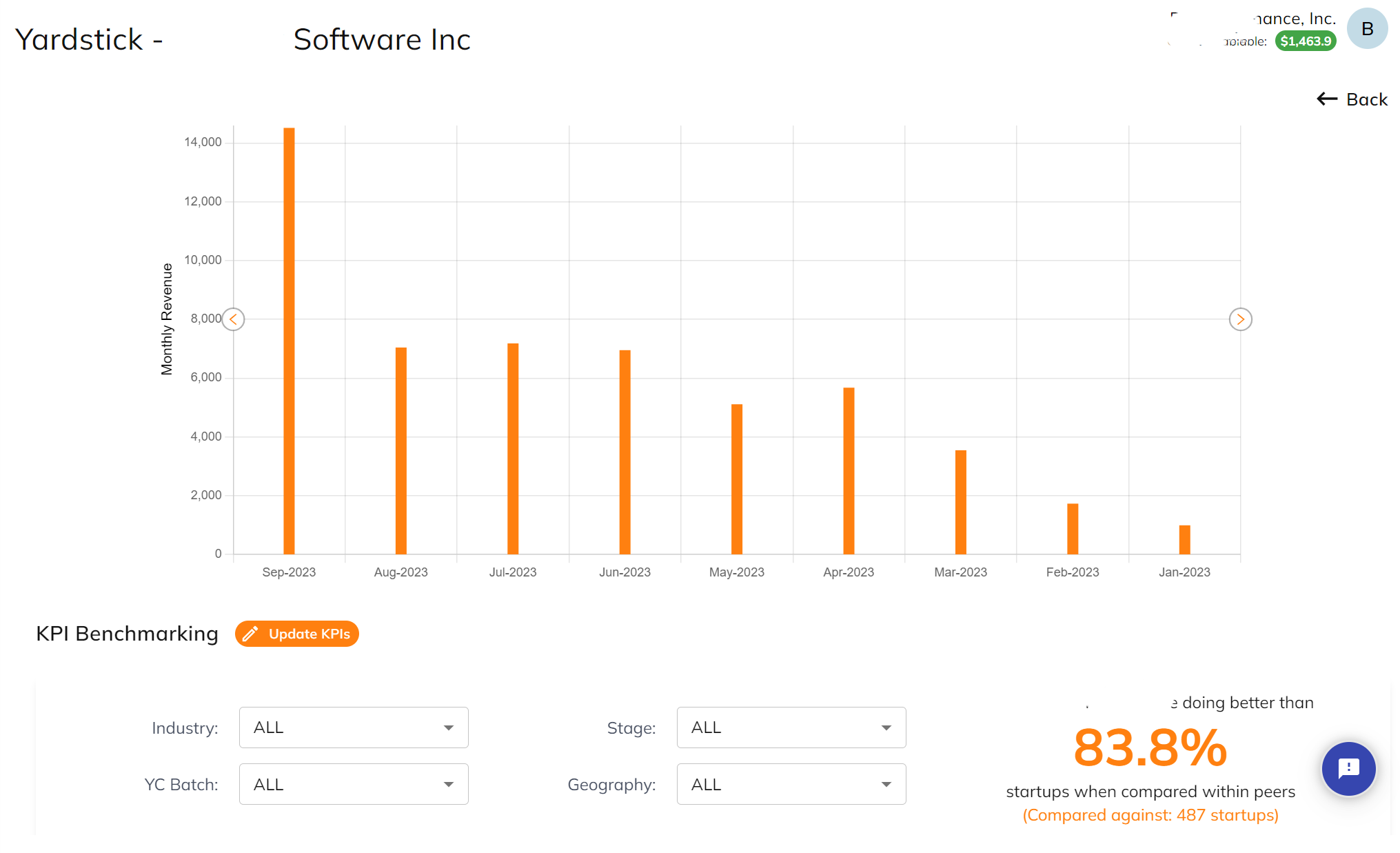

Leveraging Yardstick for Benchmarking

Our VentureInsights platform includes Yardstick, an innovative benchmarking tool. It uses commonly accepted metrics to rank startups against hundreds of their peers. The Yardstick score is invaluable, providing a quick reference to identify potential outliers for early meetings. It provided us with benchmarking data that helped us understand where each startup stood in comparison to its peers and the industry at large. This data-driven approach enabled us to make more informed decisions, ensuring that we invested in startups with the highest growth potential.

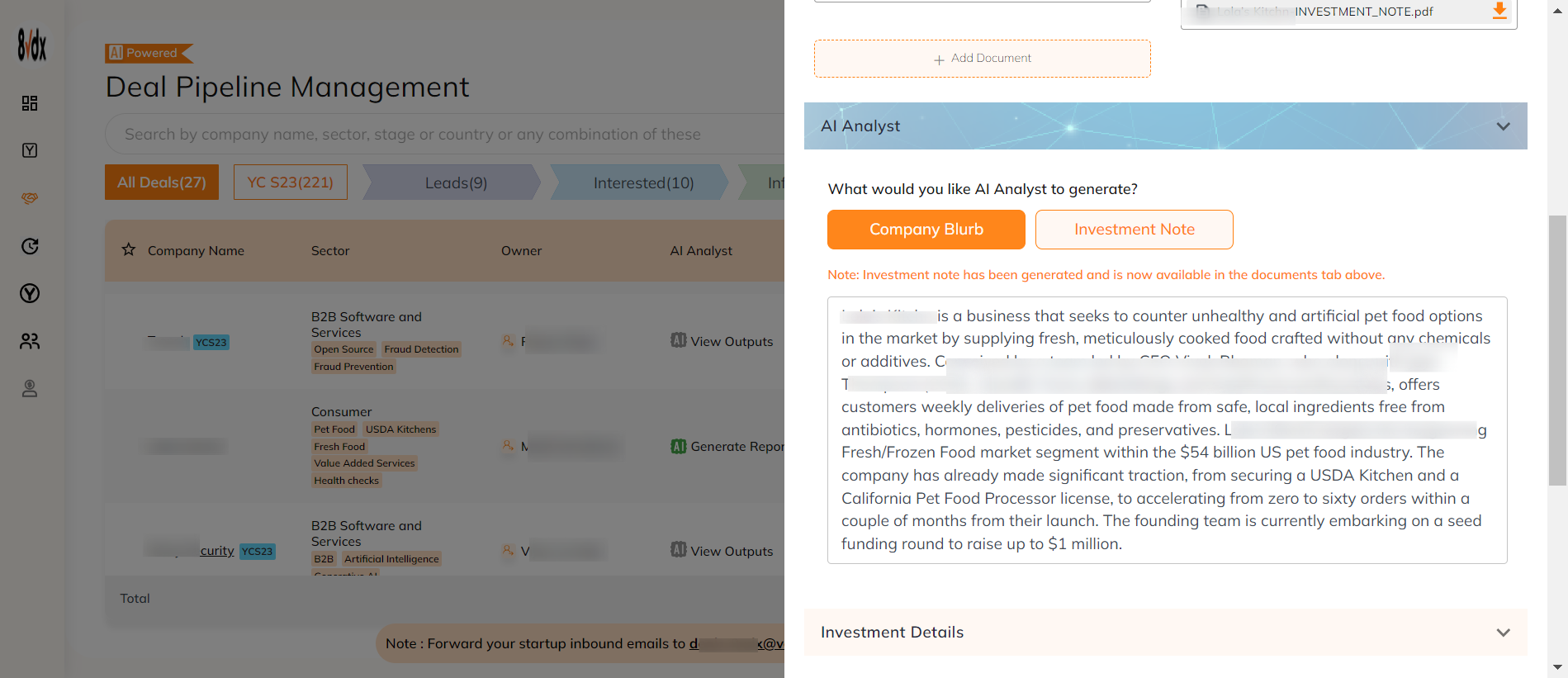

In Depth Analysis with AI Analyst

Gathering comprehensive data for seed-stage investing poses a significant challenge. Our AI-powered tools, particularly the AI Analyst, offer a solution. The AI Analyst tool is a game-changer. It generates detailed investment reports using engineering prompts for Language Learning Models (LLMs). These reports guide our investment team in shortlisting promising startups for initial meetings, ensuring we focus on the most viable candidates.

By utilizing this tool, we were able to generate comprehensive investment reports on every startup in the YC S23 batch. This allowed us to quickly evaluate and assess the potential of each company, gaining valuable insights into their market positioning, business model, growth prospects, traction and competitive advantages.

By reviewing these reports before delving into each company, we gained a comprehensive understanding of their strengths, weaknesses, and potential risks. Armed with this knowledge, our committee meetings became more meaningful and productive, enabling us to make well-informed decisions about which companies to invest in.

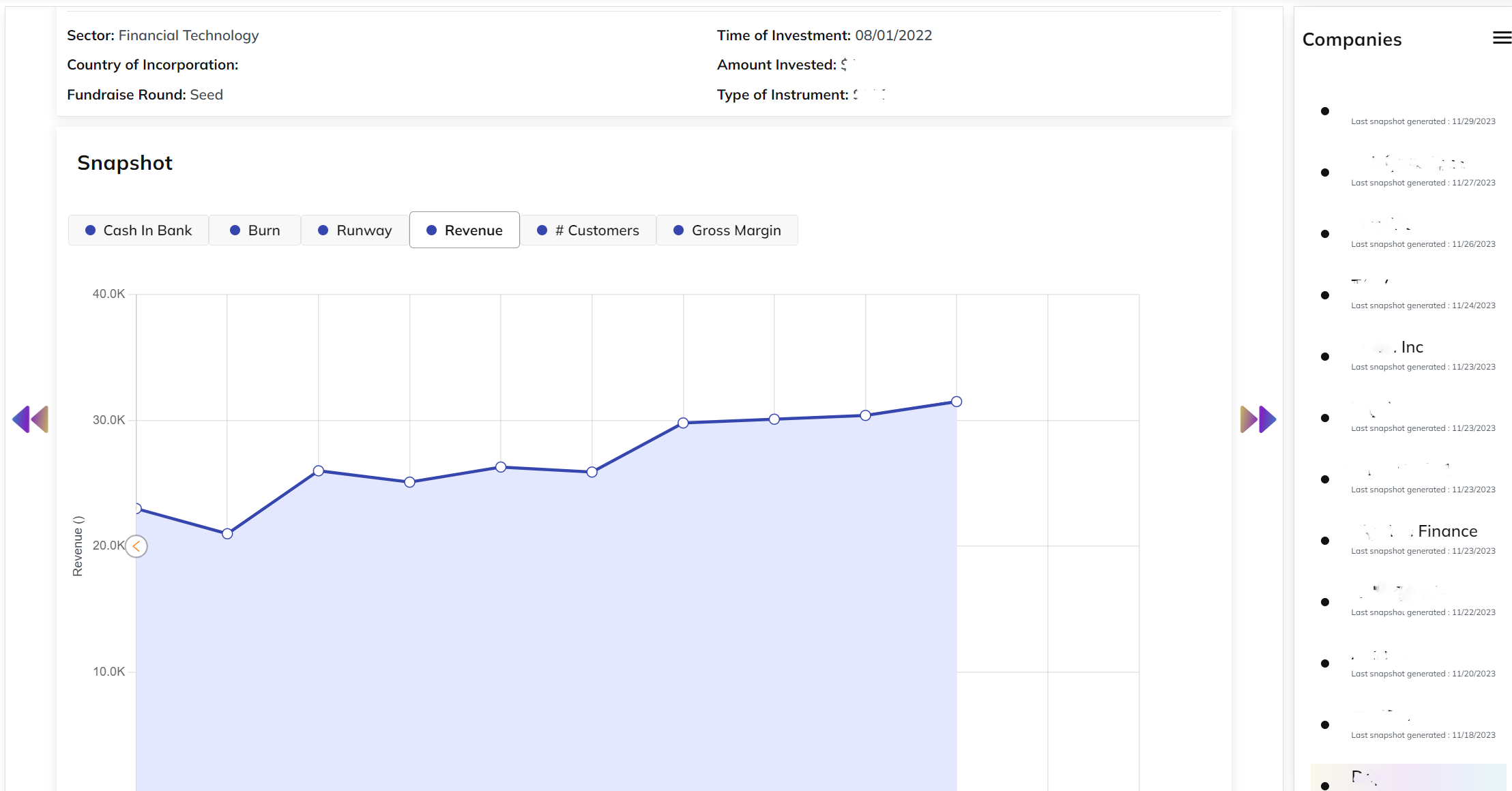

Tracking Post-Investment Progress

Beyond just managing deals and analyzing data, the 8vdx platform has facilitated a deeper engagement with the startups we invested in and were interested in. Our platform offers standardized, smart investor updates. This allows us to maintain close engagement with the startups, tracking their progress, challenges, and milestones.

Through standardized, AI-powered investor updates, we continue to stay in the loop with each company's progress, challenges, and milestones, fostering a relationship of trust and collaboration.

The Results

The outcome of our investment in the YC S23 batch has been nothing short of remarkable. We've seen incredible innovation and growth among the startups we've partnered with. These companies are not just surviving; they're thriving, breaking new ground in their respective fields, and proving that our investment strategy, powered by 8vdx, is a resounding success.

For investors looking to diversify their investments, the platform offers an opportunity to invest directly in the 8vdx Demo Day Funds. This provides investors with early access to a diverse pool of vetted startups, ensuring a balanced and high-potential portfolio. Click here to see the 8vdx Demo Day portfolio and invest with us .

Looking Ahead

As we look to the future, we're excited about the possibilities that lie ahead. The success we've experienced with the YC S23 batch is just the beginning. With the 8vdx platform, we're equipped to continue identifying and investing in the startups that will shape our world in the years to come.

Ready to revolutionize your investment approach? Start your 30-day free trial with VentureInsights today.