In today's fast-paced investment landscape, Venture Capitalists (VCs) are constantly on the lookout...

The Vital Importance of Tracking Your Angel Investments: A Tax Perspective

As an angel investor, diving into the vibrant world of startups can be both exhilarating and financially rewarding. However, amidst the thrill of scouting for the next unicorn, it's crucial to anchor ourselves in the pragmatic aspects of investment management—specifically, tracking investments for tax purposes. Understanding and maintaining a detailed record of your investment pipeline, deal flow, and the performance of your current investments are not just good practices; they're essential strategies for optimizing your tax position and ensuring compliance. Let's delve into why this meticulous approach is indispensable for every angel investor.

Maximizing Tax Benefits

Angel investing is not just about injecting capital into promising startups; it's also about leveraging the available tax incentives. Many jurisdictions offer tax benefits for investments in early-stage companies, recognizing the risks involved. These incentives might include tax credits, deductions for losses, or exemptions on gains. By meticulously tracking your investments, you can identify which tax incentives apply to your situation, ensuring you don't miss out on valuable tax savings. This process requires a clear record of investment dates, amounts, and the nature of each investment.

Navigating The Complexities of Tax Liabilities

The path of angel investing is fraught with both successes and failures. While the focus is often on the potential for astronomical returns, the reality is that some investments will inevitably underperform or fail. Tracking your investments meticulously allows you to document your losses accurately, which can be crucial for tax purposes. In many cases, these losses can offset other capital gains or even ordinary income, significantly reducing your overall tax liability. However, capitalizing on these tax rules requires detailed records of each investment's performance over time.

Ensuring Compliance and Avoiding Penalties

The tax landscape for investments, particularly in the realm of startups, can be complex and ever-changing. Regulatory bodies often require detailed reporting on investments, including the origin of funds, the nature of the investments, and any changes in investment value. Failing to provide accurate and timely information can result in audits, penalties, and interest charges. By keeping track of your investments systematically, you can ensure compliance with tax regulations, thereby avoiding unnecessary financial penalties and legal complications.

Preparing for Audits With Confidence

While the word 'audit' may send shivers down the spine of many investors, those who maintain detailed records of their investments can face audits with confidence. Should the tax authorities question the validity of your tax claims, having a well-organized record of your investment activities can swiftly address any concerns, demonstrating your compliance and the legitimacy of your claims. This level of preparedness not only mitigates the stress associated with audits but also showcases your professionalism and dedication as an investor.

Facilitating Strategic Decision-Making

Beyond compliance and tax optimization, tracking your investments provides invaluable insights that can inform your future investment decisions. By analyzing your investment pipeline, deal flow, and the performance of current investments, you can identify trends, assess the effectiveness of your investment strategy, and make informed decisions to adjust your approach. This strategic perspective is critical for long-term success in the dynamic and unpredictable world of startup investing.

Your Tale of Tax Triumph

In conclusion, tracking your angel investments meticulously is not merely a bureaucratic necessity; it's a strategic imperative that can enhance your investment outcomes. From maximizing tax benefits and ensuring compliance to facilitating strategic decision-making, the benefits of this disciplined approach are manifold. As you navigate the exciting yet challenging waters of angel investing, let the rigor of your investment tracking be the compass that guides you to financial success and regulatory harmony.

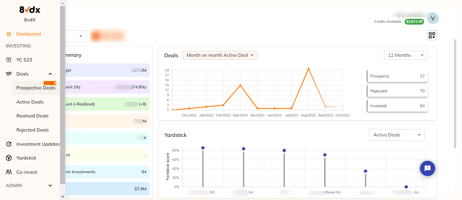

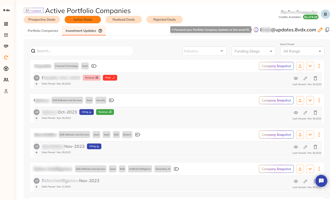

For those embarking on or continuing their journey in angel investing, remember that the key to unlocking the full potential of your investments lies not just in choosing the right startups but in managing your investments with precision and foresight. The discipline of tracking your investments for tax purposes exemplifies the blend of passion and pragmatism that defines the most successful angel investors. Luckily, our Venture Insights platform gives you an easy way to do just that.