In the dynamic startup ecosystem, making precise and informed decisions is crucial for success....

Unlocking Financial Success: The Power of Pipeline and Deal Flow Management for Investors

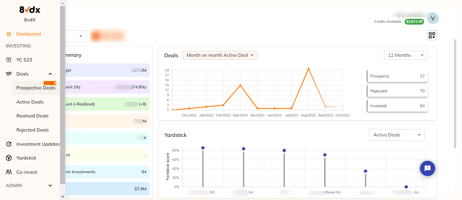

In the dynamic realm of investment, the key to unlocking substantial profits often lies not just in the decisions you make but in how you manage your opportunities—your pipeline and deal flow. For investors, whether angel investors, venture capitalists, or even private equity firms, the ability to efficiently navigate through potential investment opportunities can significantly boost profitability. This blog will explore how effective pipeline and deal flow management can be a game-changer in your investment strategy, offering a roadmap to heightened financial success.

Understanding Pipeline and Deal Flow

First, let’s clarify what we mean by 'pipeline' and 'deal flow'. The pipeline refers to the process and stages that a potential investment goes through, from initial contact to final investment decision. Deal flow, on the other hand, is the rate at which investment offers or inquiries are received. Together, they represent the lifeblood of any investment strategy, providing a systematic approach to evaluating and acting on potential opportunities.

1. Improved Decision Making

At its core, effective management of your pipeline and deal flow enhances your decision-making capabilities. By organizing potential investments based on various criteria such as industry, potential ROI, risk level, and growth stage, you can prioritize which opportunities warrant further investigation and which should be passed on. This structured approach ensures that you're not only investing in the best opportunities but also avoiding the paralysis of analysis that can come from an overwhelming number of options.

2. Efficient Resource Allocation

Time and capital are finite resources for investors. Efficiently managing your pipeline and deal flow allows for optimal allocation of these resources. By focusing on the most promising opportunities and streamlining the evaluation process, you minimize wasted effort on low-potential ventures. This efficiency not only boosts your profitability by increasing the chances of successful investments but also reduces the opportunity cost of missed investments due to resource misallocation.

3. Enhanced Risk Management

Investing is inherently risky, but managing your pipeline and deal flow can significantly mitigate these risks. Through a systematic evaluation of potential investments, you can better identify and understand the risks involved with each opportunity. This process enables a more informed risk-taking strategy, where decisions are based on a comprehensive assessment rather than gut feelings or incomplete information. By diversifying your investments across different sectors and stages, you can also spread your risk, further protecting your portfolio.

4. Strengthened Investor Relations

Investors who are adept at managing their pipeline and deal flow often enjoy stronger relationships with founders and co-investors. A structured approach to investment allows for quicker decision-making, clear communication, and more meaningful engagement with potential and current investees. This professionalism not only enhances your reputation in the investment community but can also open doors to exclusive opportunities that are not available through public channels.

5. Leveraging Data for Strategic Growth

In today’s data-driven world, the insights gained from managing your pipeline and deal flow are invaluable. By analyzing patterns, successes, and failures within your investment strategy, you can adapt and refine your approach for future success. This continuous improvement cycle, driven by concrete data, ensures that your investment strategy remains dynamic and responsive to market changes, thereby maximizing profitability.

6. The Automation and Customization Frontier

Navigating the vast investment space with a spreadsheet is like manually plotting a course for every star you visit. CRMs offer the quantum leap of automation and customization, turning repetitive tasks into automated processes and tailoring the system to fit your mission parameters. This means less time spent on mundane tasks and more time for cosmic exploration.

In conclusion, the strategic management of your investment pipeline and deal flow is not just about staying organized; it’s about strategically positioning yourself to capture the best opportunities the market has to offer. By enhancing decision-making, optimizing resource allocation, managing risks effectively, fostering strong industry relationships, and leveraging data for strategic insights, investors can significantly boost their profitability.

As we navigate the complexities of the investment landscape, remember that success is often found in the details. The disciplined management of your pipeline and deal flow is one of those critical details, serving as the foundation upon which profitable investment strategies are built. Embrace this approach, and you may find it to be the catalyst that propels your investment portfolio to new heights of financial success.